Filing Estimated Chargeable Income (ECI) is one of the earliest and most important corporate tax obligations in Singapore, yet it is often misunderstood. Many companies treat ECI as optional or delay it until final accounts are ready, only to face penalties, estimated assessments, or the loss of instalment plans.

This guide explains what ECI is, who must file it, when it is due, and how to file it correctly so companies can stay compliant, manage cash flow, and avoid unnecessary friction with Inland Revenue Authority of Singapore.

What Is Estimated Chargeable Income (ECI)?

Many directors assume ECI is optional, automatic, or something that can wait until final accounts are ready. Others confuse ECI with corporate income tax filing and only realise the mistake when penalties, estimated assessments, or lost instalment benefits appear in their IRAS notices.

Estimated Chargeable Income (ECI) is an estimate of your company’s taxable profits for a specific Year of Assessment (YA).

In simple terms, ECI is the taxable income your company expects to earn for the year before applying:

This distinction is critical. Do not deduct exemptions when filing ECI.

IRAS will compute and grant any applicable tax exemptions automatically later during the tax assessment process.

ECI allows IRAS to assess your company’s tax position early, issue a Notice of Assessment (NOA), and determine whether your company qualifies for tax instalment payments.

ECI is not just a compliance formality. It directly affects:

Companies that file ECI late or incorrectly often face immediate full tax payment demands, higher estimated tax bills, loss of instalment plans, and increased scrutiny from IRAS.

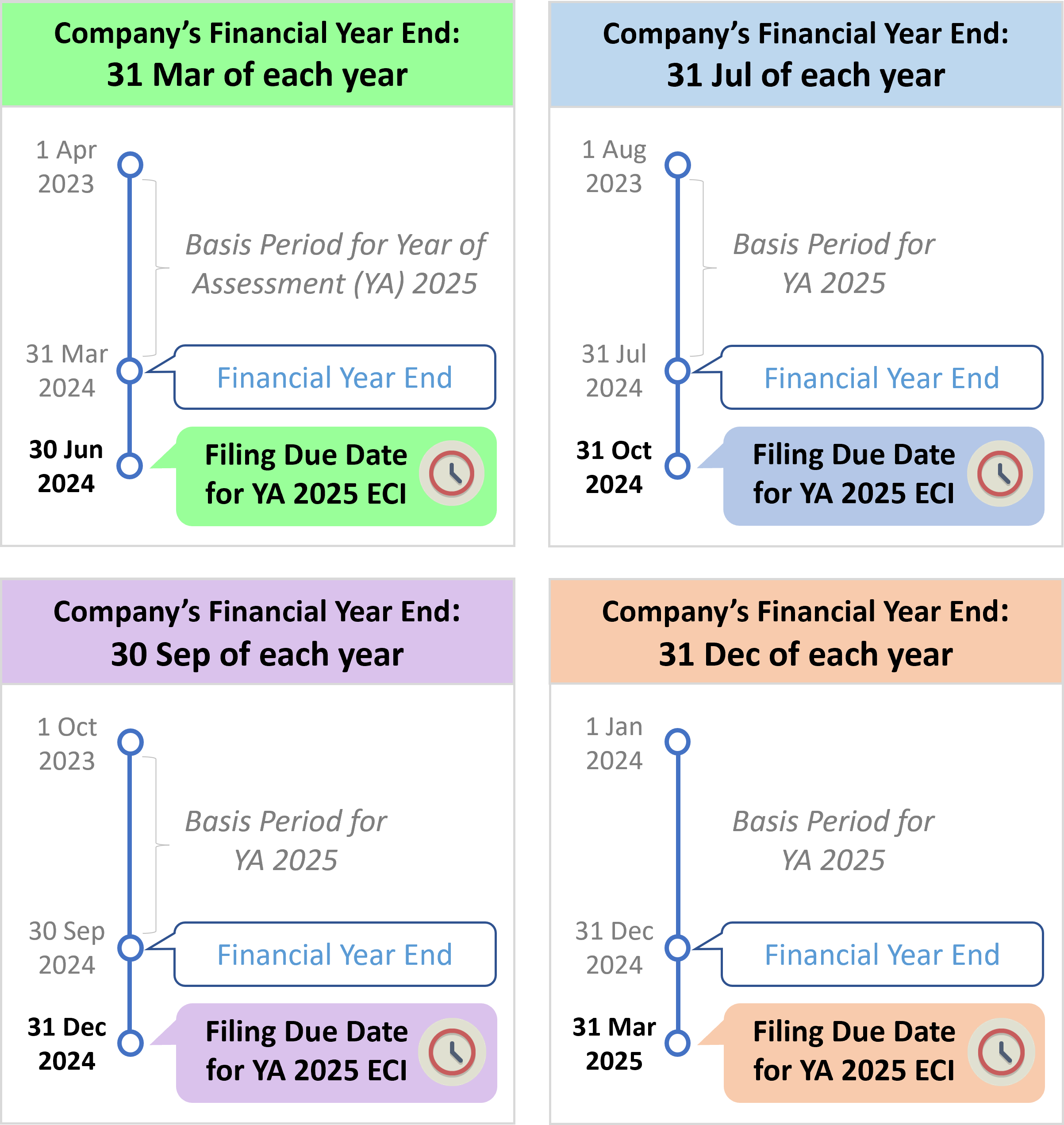

All companies must file ECI within 3 months from the end of their Financial Year End (FYE), unless they qualify for an ECI filing waiver.

This deadline is fixed and strictly enforced.

Missing this window removes your eligibility for instalments and exposes your company to estimated tax assessments.

Your company must file ECI if it:

Even loss-making companies are generally required to submit ECI unless they meet the waiver conditions.

Companies exempt from filing ECI

Your company does not need to file ECI if both conditions below are met:

If both conditions are satisfied, no filing and no notification to IRAS is required, even if myTax Portal shows “Ready to File”.

Certain entities are also exempt, including foreign ship owners with Shipping Returns, foreign universities, designated unit trusts, approved REITs, and companies with IRAS-approved waivers.

Filing ECI early unlocks one of the most overlooked benefits in Singapore’s tax system: instalment payments.

The earlier you file, the more instalments IRAS allows.

To qualify, your company must be Singapore-registered and have GIRO approved before the tax payment due date.

Late filing often forces companies to pay the entire tax amount in one lump sum within one month.

If ECI is not filed on time, IRAS may issue an Estimated Notice of Assessment based on historical data or industry benchmarks. These estimates are often higher than actual taxable income.

Key consequences include:

Even if your company objects to the estimated assessment, payment must still be made first. Refunds are only processed if IRAS later revises the assessment.

Audited accounts are not mandatory at the ECI stage. However, accurate financial data is essential.

Typically required:

IRAS allows the use of management accounts if audited figures are not yet available, provided the ECI amount remains accurate.

ECI is not simply net profit. Adjustments must be made for non-deductible expenses, capital allowances, and separate source income.

Example

Company A reports:

Calculation steps:

Start with net profit before tax

→ 35,000

Remove separate source income

→ 35,000 − 5,000 = 30,000

Add back non-deductible expenses

Adjusted profit

→ 33,500

Apply capital allowances

Adjusted profit

→ 28,000

Add back net rental income

→ +4,500

Final ECI (before exemptions)

→ S$32,500

Report to IRAS:

Before starting your ECI submission, make sure you have the right access and information in place.

You must be officially authorised by your company as an Approver for Corporate Tax (Filing and Applications) under Corppass. If this access has not been set up yet, follow the step-by-step Corppass setup guides to avoid delays.

You should also have your Singpass credentials ready, along with your company’s Unique Entity Number (UEN) or Entity ID, as these are required to access IRAS digital services.

ECI is filed electronically through mytax.iras.gov.sg.

If you need guidance during the process, IRAS provides detailed filing manuals:

When filing ECI, your company must declare its revenue, which refers only to income generated from its principal business activities.

Revenue should exclude items such as gains from the disposal of fixed assets. For investment holding companies, revenue typically consists of investment income, including interest and dividend income.

If audited financial statements are not available at the time of filing, you may rely on management accounts to declare the revenue amount. Where the final audited revenue differs from the figure submitted earlier, but the ECI amount remains unchanged, there is no requirement to revise the revenue declared during ECI filing.

ECI instalments allow companies to spread tax payments across the year, improving cash flow predictability.

Key points:

Late or incorrect filing often results in fewer instalments or larger combined deductions.

These errors frequently cost more to fix than getting the filing right the first time.

When handled correctly, ECI is not just a compliance obligation. It is a planning tool that helps companies manage tax exposure, preserve instalment benefits, and avoid unnecessary friction with IRAS.

Companies that treat ECI seriously tend to face fewer surprises, maintain healthier cash flow, and stay audit-ready throughout the year.

At ATHR, we support Singapore companies across the full spectrum of accounting and tax compliance, from early-stage startups to growing SMEs and regional groups. Our services include corporate tax consulting covering corporate income tax, GST, contractor and cross-border tax matters, monthly and annual accounting prepared in accordance with Singapore Financial Reporting Standards (SFRS), QuickBooks consulting and licensing, as well as corporate income tax return and GST return preparation. By combining accurate financial reporting with practical tax guidance, we help businesses stay compliant, optimise cash flow, and operate with confidence in Singapore’s regulatory environment.

Book a call with ATHR today to structure your Singapore tax season 2026 correctly and avoid preventable compliance stress.